This report presents an independent review of market outcomes from Western Australia’s Wholesale Electricity Market (WEM) in Q3 2025.

Download the full report (PDF, 5.5 MB)

The material contained in the review is based entirely on publicly available data and is intended to complement the data and insights published by AEMO and other WEM stakeholders.

Some highlights from Q3 2025:

New Winter peak operational demand record

There was a new Winter peak operational demand record of 3,977 MW at 6:25pm on Monday 28 July 2025.

- The record was broken three times within a week, first on 21 July 2025 (3,676 MW) and then on 24 July 2025 (3,758 MW).

- The previous record was 3,673 MW set at 6pm on 26 June 2023.

Large batteries stave off minimum operational demand records

On 27 September 2025 at 12:05pm, AEMO reported that the unscheduled minimum demand record was also broken (449 MW), however the minimum operational demand of 819 MW remained well above the record low of 523 MW due to charging from the utility-scale battery fleet.

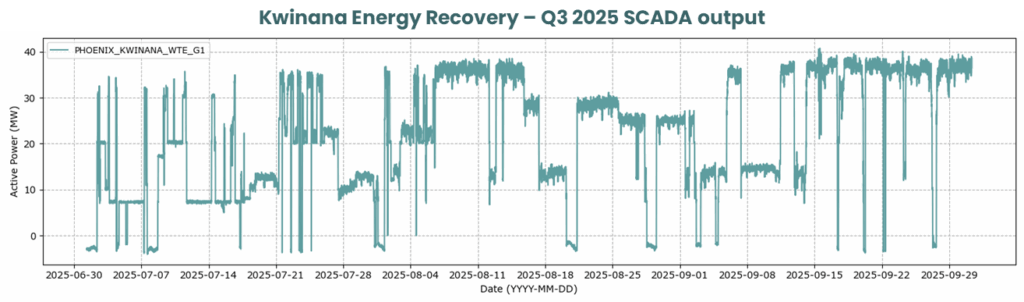

Kwinana Energy Recovery comes online

Kwinana Energy Recovery (PHOENIX_KWINANA_WTE_G1) underwent commissioning tests in Q3 2025 and appears to be progressing well:

Download the full report (PDF, 5.5 MB), which includes the following additional information:

- System demand duration curves and monthly time-of-day averages

- Generation mix

- Volume-weighted energy prices

- Average time-of-day Essential System Services prices and cleared quantities

- Total WEM spot market costs

- Facility level metrics (duration curves, time-of-day averages, capacity factors, spot revenues and average energy capture prices) for the following selected facilities:

- Bluewaters BW1-G2

- Collie G1

- Muja G7

- Kwinana GT2

- Newgen Kwinana CCG1

- Kwinana Swift GT1

- Alinta Pinjarra U1

- Kwinana ESR1 (KBESS1)

- Kwinana ESR2 (KBESS2)

- Collie ESR1

- Collie BESS2

- Collgar Wind Farm

- Merredin Solar Farm

- Warradarge Wind Farm

- Yandin Wind Farm