This report presents an independent review of market outcomes from Western Australia’s Wholesale Electricity Market (WEM) in Q3 2024.

Download the full report (PDF, 4.8 MB)

See also the RenewEconomy article covering the report (11 October 2024) and the Energy Insiders podcast all about the WEM.

The material contained in the review is based entirely on publicly available data and is intended to complement the data and insights published by AEMO and other WEM stakeholders.

Some highlights from Q3 2024:

Minimum demand season is back!

The Spring shoulder season (September to November) has arrived and with it, daytime system minimum demands are already threatening to break records.

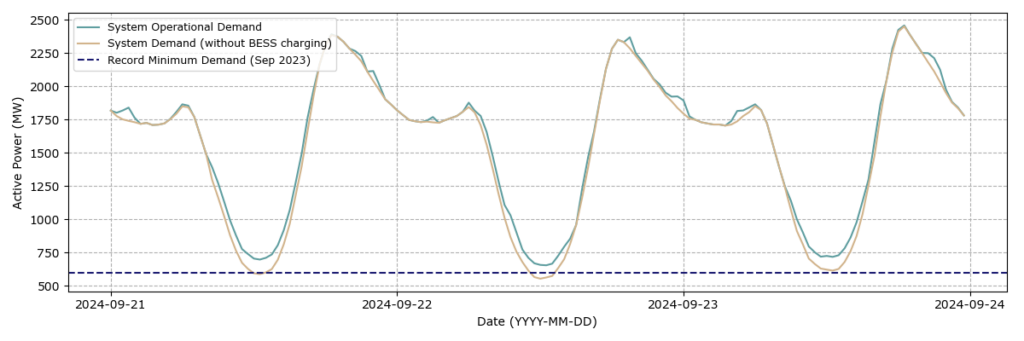

The record minimum demand of 595 MW was set in September 2023. This September, the record would have been broken had it not been for Kwinana BESS at near full charge during the middle of the day. On consecutive days from Saturday 21/09 to Sunday 22/09, the minimum demand record would have been broken were it not for BESS charging:

Now with over 1.3 GW of new BESS facilities currently under construction or being commissioned, will we ever see minimum demand records again in future Spring shoulder seasons?

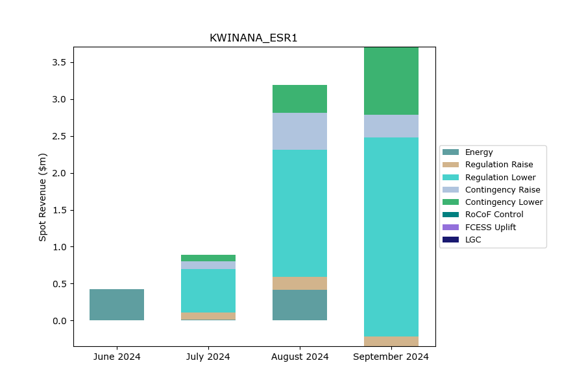

Kwinana BESS 1 is accredited for FCESS

Kwinana BESS 1 (KWINANA_ESR1) was accredited for Contingency and Regulation FCESS in July 2024 and is now making most of its real-time market revenue from providing FCESS.

New BESS facilities are coming online

Kwinana BESS 2 (KWINANA_ESR2) has now been registered in the market, with commissioning expected towards the end of 2024.

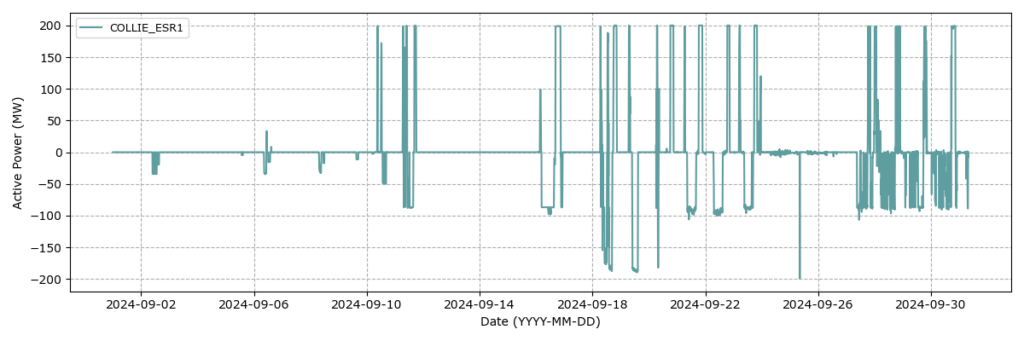

Collie Battery Stage 1 (COLLIE_ESR1) has started its commissioning tests and can be seen to be charging and discharging its full registered capacity (200 MW) in September:

Download the full report (PDF, 4.8 MB), which includes the following additional information:

- System demand duration curves and monthly time-of-day averages

- Generation mix

- Volume-weighted energy prices

- Average time-of-day Essential System Services prices and cleared quantities

- Total WEM spot market costs

- Facility level metrics (duration curves, time-of-day averages, capacity factors, spot revenues and average energy capture prices) for the following selected facilities:

- Bluewaters BW1-G2

- Collie G1

- Muja G7

- Kwinana GT2

- Newgen Kwinana CCG1

- Kwinana Swift GT1

- Alinta Pinjarra U1

- Kwinana ESR1 (KBESS1)

- Collgar Wind Farm

- Merredin Solar Farm

- Warradarge Wind Farm

- Yandin Wind Farm