This report presents an independent review of market outcomes from Western Australia’s Wholesale Electricity Market (WEM) in Q2 2025.

Download the full report (PDF, 3.6 MB)

The material contained in the review is based entirely on publicly available data and is intended to complement the data and insights published by AEMO and other WEM stakeholders.

Some highlights from Q2 2025:

Large-scale battery charging stabilises Autumn shoulder minimum operational demand

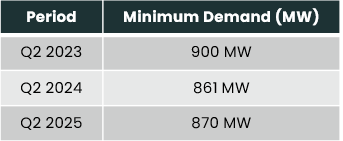

Minimum system (operational) demands in the Autumn shoulder season remained relatively flat from previous years:

This is despite >200 MW of additional DER being installed in the SWIS from 2024 to 2025, which would have been expected to drive minimum demands lower.

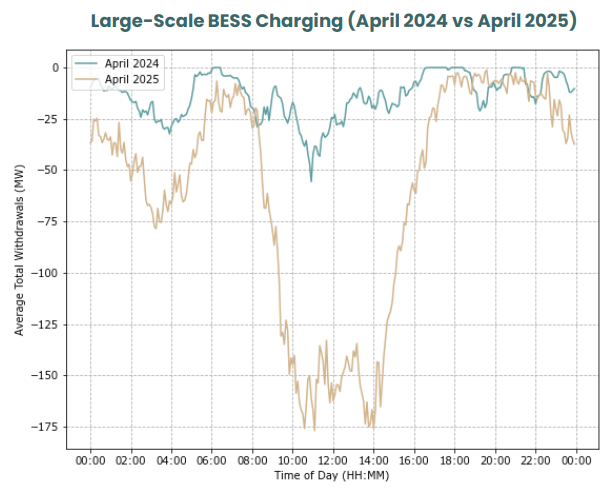

However, there was a significant increase in large-scale battery energy storage system (BESS) charging during the middle of the day as shown on the figure to the right comparing total BESS charging between April 2024 and April 2025.

This is further evidence to suggest that large-scale BESS is effectively mitigating the system security risks arising from low operational demand that was identified ~5 years ago. We will see if this remains true over the Spring shoulder season.

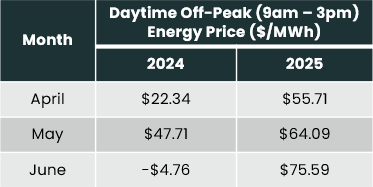

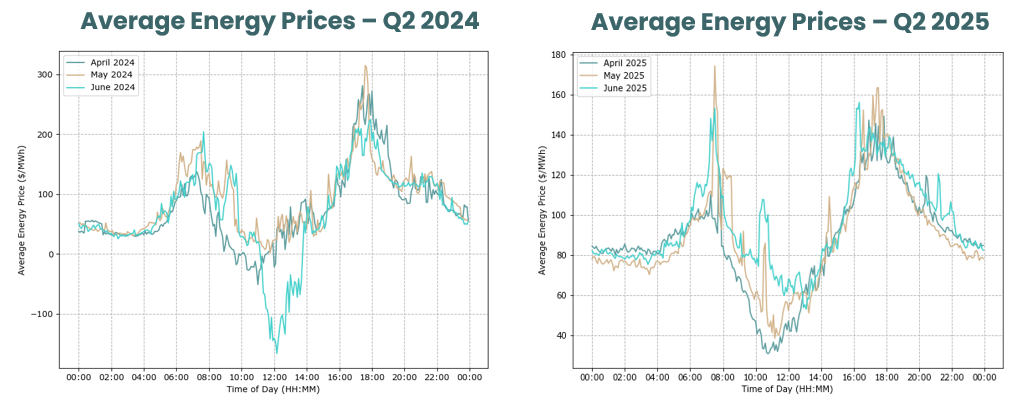

Average energy prices no longer dip below zero in the middle of the day

Average daytime off-peak energy prices have remained relatively high in Q2 2025 when compared with Q2 2024:

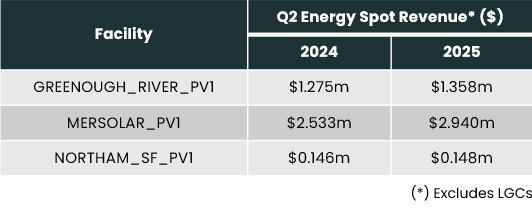

This has also seen energy spot revenues rise for utility-scale solar when compared with Q2 2024:

BESS energy price spreads have also shrunk, but BESS make up for it with increased FCESS share

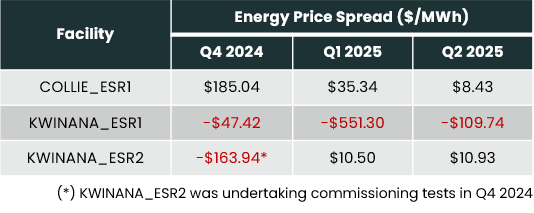

With higher daytime prices, average BESS energy price spreads (the difference between the energy price when the BESS is charging and discharging) also appear to be narrowing:

Note that KWINANA_ESR1 and KWINANA_ESR2 are part of a larger Synergy portfolio and are optimised for the profitability of the entire portfolio and not the individual assets. The persistent (and large) negative energy price spreads for KWINANA_ESR1 may be reflective of this broader trading strategy (although KWINANA_ESR1 is still profitable due to FCESS revenues).

Despite narrowing energy price spreads, BESS are still able to remain profitable by trading on volatility and participating in FCESS markets.

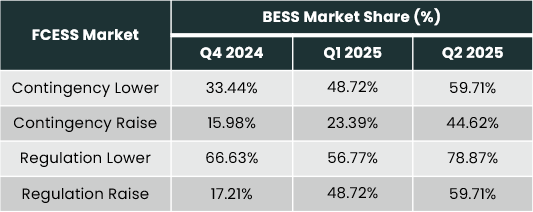

The market share of BESS in FCESS markets has been steadily increasing over the past year and BESS facilities are now providing the majority of services in all FCESS markets (except for Contingency Raise):

KWINANA_ESR2 was accredited for FCESS in June 2025, and with new BESS facilities (COLLIE_BESS2, COLLIE_ESR3 and COLLIE_ESR4) entering later in the year, we expect this trend to continue.

However, FCESS prices also fell sharply in June 2025 despite rising procurement volumes. We will see how this plays out in the next few months.

Download the full report (PDF, 3.6 MB), which includes the following additional information:

- System demand duration curves and monthly time-of-day averages

- Generation mix

- Volume-weighted energy prices

- Average time-of-day Essential System Services prices and cleared quantities

- Total WEM spot market costs

- Facility level metrics (duration curves, time-of-day averages, capacity factors, spot revenues and average energy capture prices) for the following selected facilities:

- Bluewaters BW1-G2

- Collie G1

- Muja G7

- Kwinana GT2

- Newgen Kwinana CCG1

- Kwinana Swift GT1

- Alinta Pinjarra U1

- Kwinana ESR1 (KBESS1)

- Kwinana ESR2 (KBESS2)

- Collie ESR1

- Collgar Wind Farm

- Merredin Solar Farm

- Warradarge Wind Farm

- Yandin Wind Farm