In October 2023, the Wholesale Electricity Market (WEM) in Western Australia introduced a real-time inertia market called the RoCoF Control Service (RCS). While the name of the service suggests broader possibilities, the current WEM rules define inertia as “the kinetic energy (at nominal frequency) that is extracted from the rotating mass of a machine coupled to the power system to compensate an imbalance in the system frequency [WEM Rules (1 April 2024) pg 724 Chapter 11 Glossary], thus reducing it, for the time being at least, to a market for synchronous inertia.

Market Design

The RCS provides a real-time price for inertia that is co-optimised with energy, contingency raise service and the largest contingency size. Because providing synchronous inertia essentially requires an ahead commitment decision (as there are currently no inertia providers in the WEM that could feasibly start within a 5-min dispatch interval), price signals would largely be transmitted via the pre-dispatch process, although in theory, real-time prices may be high enough for long enough to induce a commitment decision.

An interesting implication of a competitive real-time inertia market is that prices would theoretically be zero if enough facilities were already committed for energy and/or other frequency co-optimised essential system service (FCESS) to fully satisfy the inertia requirement.

Theoretical offer pricing for inertia

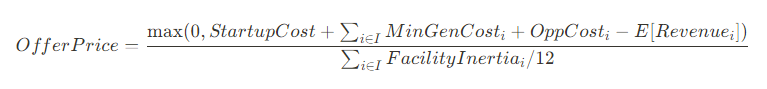

In a competitive market, a theoretically efficient offer price for inertia (i.e. the offer price at which a market participant is indifferent to providing inertia) can be expressed as follows:

where

- OfferPrice is the theoretically efficient RCS market offer price ($/MW.s/hr)

- I is a set of intervals reflecting the number of future intervals that the facility is expecting to participate in the RCS market

- StartupCost is any facility startup cost that is expected to be incurred ($)

- MinGenCost is the cost of operating the facility at minimum generation ($)

- OppCost is the opportunity cost of operating the facility, such as profits from selling the fuel that would otherwise be used to run the facility ($)

- E[Revenue] is the market revenue that the market participant is expected to earn from the energy and FCESS markets ($)

- FacilityInertia is the accredited inertia of the facility (MW.s)

Several example scenarios are examined below:

Scenario 1: Facility committed for energy and FCESS

When a facility commits for energy, then a calculation would have already been made by the market participant that the expected revenue from the energy market and FCESS would exceed the startup costs, opportunity costs and operating costs at minimum generation. The theoretical offer price would thus be $0/MWh.

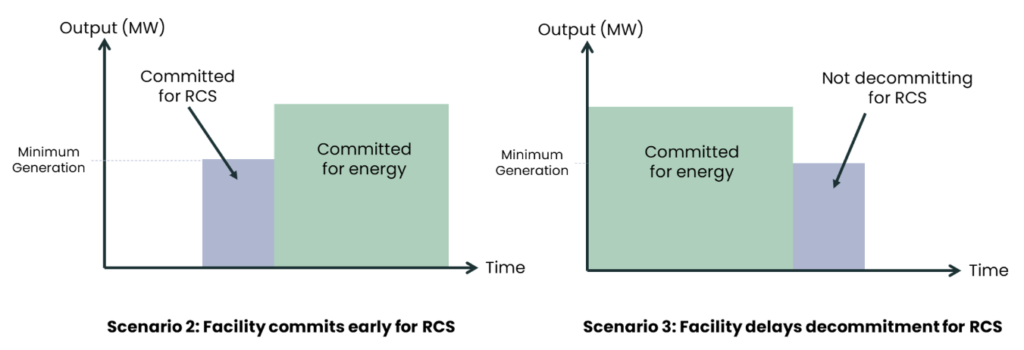

Scenario 2: Facility commits early for RCS

If a facility plans to commit at a certain time (e.g. due to expected energy prices being high enough to recover costs), then a facility would only commit earlier for RCS if the price is high enough to recover startup costs, opportunity costs and shortfalls in expected energy revenue. The theoretical offer price would be non-zero.

Scenario 3: Facility delays decommitment for RCS

A facility may elect to decommit from the market when expected energy and FCESS prices become too low, and would only remain committed for RCS if the price is high enough to recover opportunity costs and shortfalls in expected energy revenue. The theoretical offer price would be non-zero.

Market Outcomes

Real-time RCS market outcomes

The RCS market has effectively cleared at ~$0/MW.s/hr since market commencement. This is largely because of the RCS offer price ceiling set by the Economic Regulatory Authority (ERA) just before market start in September 2023. While the RCS offer price ceiling for the first 5 months of the new market was determined to be $300/MW.s/hr (due to a requirement in WEM Rules clause 1.60.5 that the offer price ceiling for all FCESS markets must be a single identical price for the first 5 months of the new market), the ERA determined that the RCS offer price ceiling would be $0/MW.s/hr from 1 March 2024.

ERA’s argument is that once a unit is committed for energy (or any other FCESS), the short-run marginal cost (SRMC) of inertia is zero. This is because the WEM is a “self-commit” market and the WEM dispatch engine (WEMDE) cannot force a facility to come online (unless it is offered as a fast start facility). As a result, facilities need to commit through appropriately priced energy bids in order to be dispatched by WEMDE to (at least) their minimum generation level. And so the logic goes that once committed for energy, the facility incurs no additional cost for providing inertia.

During the consultation process, there were stakeholder comments noting the ability of some generators to operate in synchronous condenser mode, but the ERA was not provided with any operational costs to substantiate a non-zero inertia price.

This interpretation reflects the idea of synchronous inertia as only having value at commitment, but not necessarily any value in real-time. Perhaps the original sin of the RCS market design was to combine elements of an ahead market (without physically binding commitments) with a self-commit real-time market, especially in a market like the WEM that explicitly requires real-time market offers to “reflect only the costs that a Market Participant without market power would include in forming profit-maximising price offers” [WEM Rules clause 2.16A.1].

However, perhaps providing synchronous inertia does incur a real-time cost from the perspective of decommitment, i.e. the opportunity cost of a facility decommitting and removing its inertia from the system. While WEMDE cannot force a facility to come online (unless it is offered as a fast start facility), it can potentially keep facilities from decommitting out of the energy market if FCESS prices justify it. Scenario 3 above is one such example where a facility would be indifferent to decommitting if the RCS price was sufficiently high. That said, the practical difficulty for the ERA would be to determine an appropriate RCS offer price ceiling that reflects these costs, and then monitoring the market to ensure that it is operating efficiently.

In any case, if it were just the $0/MW.s/hr offer price ceiling, then it would probably be a minor issue. But it is an interaction with another mechanism that appears to cause some genuine distortions in the market.

FCESS uplift payments

While the RCS market has cleared at ~$0/MW.s/hr, there has actually been ~$62m of payments for RCS in the first 7 months of the market (roughly ~$1/MW.s/hr) via the FCESS uplift payment mechanism.

The FCESS uplift payment mechanism was designed to be an out-of-market make-whole payment for facilities that are enabled for FCESS by WEMDE (i.e. constrained on), but end up losing money in the energy market (i.e. the energy market clears at below the facility’s energy offer for its minimum output to provide FCESS). In principle, this mechanism ensures that facilities continue to offer their FCESS capability to the market, and not withdraw this capability when there is a risk that the energy market is turning.

However, the interaction of the $0/MW.s/hr RCS offer price ceiling and the FCESS uplift payment mechanism creates some perverse incentives:

- FCESS uplift payments are out-of-market corrections (settled ex post), so WEMDE doesn’t consider this in its optimisation

- RCS offers of $0/MW.s/hr means that WEMDE doesn’t co-optimise RCS properly either (as it thinks it is free), causing inefficient dispatch, e.g. WEMDE can prevent a unit from decommitting to take advantage of the free inertia it is providing

- The facility that is constrained on for RCS faces no energy price risk as it is made whole through the FCESS uplift payment mechanism if energy prices clear too low

- There is also a potential incentive for a facility to price their other FCESS capability at $0/MW/hr (i.e. be a pricetaker), and use the uplift mechanism to mitigate any losses. As long as a facility offers energy at its SRMC, it is probably not in breach of any rules.

In effect, this interaction between an RCS offer price ceiling of $0/MW.s/hr and the FCESS uplift payment mechanism acts like a free put option for a facility. If the facility prices its energy offers at SRMC and its FCESS offers at $0/MW/hr, and it believes it would be constrained on for FCESS by WEMDE, then it would earn infra-marginal rents when the energy market clears above SRMC, and is made whole when the market clears below SRMC.

By way of example, one facility that has historically had a capacity factor of less than 6% has operated at a capacity factor of 48.9% for the 4-month period from 1 January to 30 April 2024, all the while receiving ~$9.4m in uplift payments for RCS.

Final thoughts

It’s probably safe to say that the WA real-time inertia market hasn’t panned out the way it was originally envisaged it would and is in need of a few tweaks. I’m not sure this is anyone’s fault either as the implications of various design decisions and their interactions do not seem to have been foreseen, and market participants are simply playing by the rules and responding to the incentives in front of them. However, there are some unintended consequences with real costs from the current market rules and its implementation.